The CCI strategy is a favourite among many beginners and experienced traders. It allows you to make money on the price difference by predicting the direction of quotes. The key aspect of successful stock trading is the compilation of a quality methodology. Today we will consider several variants of using the popular indicator and provide clear recommendations for action. Having received these tips, a trader will be able to improve his trading result.

What is a CCI strategy?

It is a trading tactic based on the CCI indicator – Commodity Channel Index. This software development is considered to be a rather effective custom oscillator. At the same time, its calculation algorithm is markedly different from programmes with a similar purpose. It can be used in practice as a complex analytical tool, but in some cases the system is used independently of others. With the correct settings of the indicator, it turns into a full-fledged assistant of a professional trader.

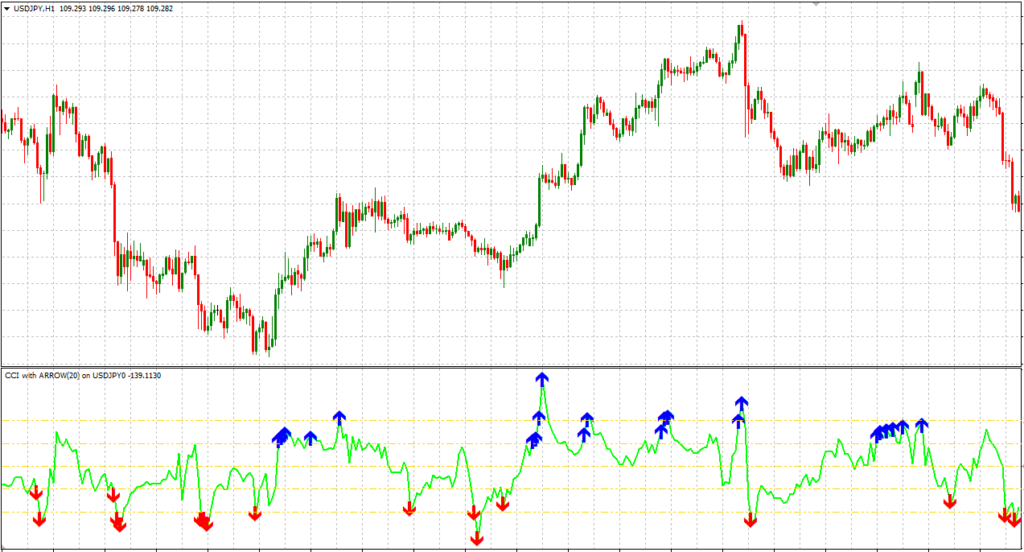

A simple and understandable strategy is built on the development of CCI, which is available even to novice traders. This custom oscillator is included in the standard set of Metatrader. It is visualised in the form of a classic curved line, which is built in an additional window below the price chart. In addition, the system has two levels with standard values of overbought and oversold zones.

The strategy based on CCI Forex was originally used to work with graphical visualisations of values, showing the pricing of commodities. The formation of such financial assets is characterised by cyclicality, and therefore it is much easier to predict. For example, the cost of oil often rises in the cold season, while in summer its price usually falls. When trading commodities, the indicator can be used to identify optimal points of entry into the market.

Using a technical tool to determine price movements, a trader should remember that the programme was originally developed for raw materials. The volatility of the currency and stock market is much higher, and therefore these platforms differ in some peculiarities of pricing. Numerous political and economic factors influence the formation of quotations of national currencies. When forecasting currency rates, it is necessary to take into account not only technical, but also fundamental analysis of the marketplace.

Top 3 best strategies

In the network there is no universal trading methodology that would solve all the problems of a modern trader. At the same time, each player can find his own optimal variant of actions and reach an acceptable level of earnings. Below we describe three CCI strategies that allow you to get rich on the price difference:

- The simple version involves placing orders according to the intersection of oversold or overbought lines. If the cost reaches the +100 zone and moves from bottom to top, you should buy the financial asset. In cases when the rate moves from top to bottom and reaches the -100 mark, it is recommended to sell the investment instrument. In most sources, the key signal for placing orders is crossing the oversold/overbought zone

- To increase the accuracy of market entry, a trader can combine two indicator programmes. The CCI+RSI strategy implies the use of instruments from the oscillator group. These technical devices demonstrate fluctuations on the chart, after which there is an exit from the usual values and the presence of a strong trend is determined. Thus, there is a clear deviation of the market from the state of equilibrium.

- Together with the CCI software, a trader can use the Slope Direction Line. This is a moving average, which changes its colour when the current trend changes. Taking into account its values, a trader will quickly determine the direction of quotes and place appropriate orders. This tool will facilitate decision-making on short time intervals. It will allow you to quickly orientate in the market situation and determine the movement of rates.

If a trader likes one of the above techniques, he can download a strategy based on CCI. Before using this tactic in practical trading, the speculator should test it on a demo account. The strategy that will show its effectiveness during testing can be used for full-fledged trading on the international marketplace.