In this article we will look at Forex indicators that are oscillators. They look at the situation at a particular moment in time, allowing you to immediately recognise whether currency pairs are oversold or overbought. Often oscillators look like a line chart at the bottom of the screen, above the volume indicators. When currency pairs are overbought, it means trading at the upper boundary of the current price range. Their predisposition to corrective movement is observed. Oversold assets touch the bottom of the current market prices, and have the potential to rebound to a higher level.

Let’s consider Forex indicators in the context of working in flat conditions

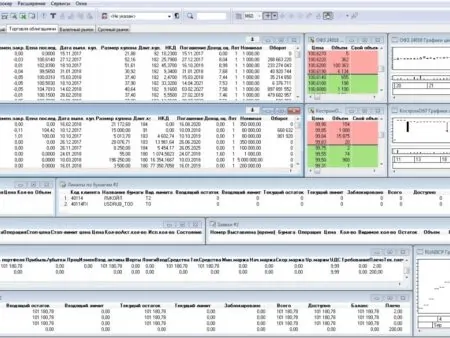

Oscillator is a technical tool used to work on markets that are in sideways movement. That is, signals are given when there is no clearly expressed trend. Most Forex MT4 indicators of this type are visualised in a window separate from the chart. They look like a set of curves. The latter show some fluctuations. Oscillators have a certain number of settings. Thanks to them, the trader receives signals of higher clarity. Interaction with oscillators is performed mainly according to the following scheme: it is necessary to look for signals for a reversal from the local trend currently in progress within the boundaries of the general range movement.

Let’s imagine that on the market the value of the euro-dollar pair changes within the corridor of 1.1250-1.1500. Then what can a trader do? Buy at the lower boundary and sell the asset at the upper boundary. However, the cost will not every time make a reversal at the levels indicated above. Also, periodically the range can change its position on the chart, becoming from sideways to sloping. It is in such cases that Forex in MT4 oscillator indicators are needed, because they show when a trend reversal is possible. These technical tools calculate the areas of overheating and cooling of the market, thanks to which the trader better understands the essence of events and gets the opportunity to learn about the market reversal in advance. A strong signal appears when the oscillator lines go beyond the boundaries of oversold and overbought zones.

Pros and cons of oscillators

These technical tools are good because:

- They signal the reversal of the local trend in advance. This gives traders a reserve of time, which they spend on thinking about the situation and making a balanced decision.

- Variety of incoming signals. Stochastic alone is capable of generating three varieties. It allows to be in the market almost all the time.

- Comparative simplicity of the tool. For most situations it will be enough to follow the curve and its position in relation to other elements of the algorithm.

- The flexibility of settings allows you to modify Forex indicators to your own requirements.

However, some disadvantages are also present:

- There will be a large number of false signals when moving to a trend. This group of technical assistants will not show how the market situation has changed. They will continue to transmit reversal signals even during the beginning of the formation of a stable trend. This forex MT4 indicator simply does not know how to rebuild, because it shows reversals only in flat boundaries.

- There are no 100% triggering settings. Frankly speaking, such a flaw is inherent in any technical analysis tool. The settings are really flexible, but it is impossible to find such a ratio of them that they give only positive results. Each situation requires its own options.

Most popular examples of technical analysers

Among the best known MT4 indicators are Stochastic, RSI Relative Strength Index, Williams Percent Range. All of them cope well with their classic functions, allowing the trader to make money.