Brokers that have a licence from regulators are in particular demand. This is natural, because it is they who can provide complete security in making transactions, which is what every trader is looking for. But sometimes it happens that even companies with documents from the most authoritative supervisory bodies are called fraudulent. One of such companies today is TeraFX. To make sense of it all, let’s turn to its thorough review.

Legality

TeraFX broker, according to the ‘Why Us?’ section of its website, is operated by Tera Europe Limited, one of the recognised financial institutions in the UK. Also, this tab indicates that the financial assistant we are talking about has received a licence from the FCA. This is quite a serious statement, because it is not easy to get authorisation documents from this regulator. For this purpose, brokers need to fulfil a number of requirements and have on their account 730 thousand euros of insurance capital in case of bankruptcy. Despite this, terafx.com actually boasts a licence from one of the strictest supervisory bodies in the world – the British FCA.

Simply put, it’s legal to work with TeraFX, which means we can safely move on to reviewing its terms and conditions.

Tariff plans

Like many other financial assistants, terafx.com offers traders to use one of its account types. There are 3 options to choose from:

- Minimum deposit Maximum leverage Spreads

- Micro $100 1:400 From 1.8 pips

- Standard 500 dollars 1:400 From 1.2 pips

- Premium 10 thousand dollars 1:200 From 0,6 points

Despite the name, the Micro plan offers unacceptable conditions for the company’s clients. The fact is that micro accounts at TeraFX’s competitors start at an average of $5. In addition, the leverage of 1:400 is a gross violation of all the rules of the British regulator, which allows companies to offer a maximum of 1:30. And finally, spreads: the value of 1.8 points exceeds the market average and exposes investors to additional risks. At this stage, there are doubts about the legality of the broker’s work, although we already know that everything is in order with the documentation.

Clients of terafx.com are offered to work with indices, currency pairs and commodities.

Trading terminal

TeraFX is one of the few companies that is able to offer its clients all MetaTrader4 and MetaTrader5 distributions. We downloaded the software offered by the broker, and already inside the development we learnt that the spreads on the EUR/USD currency pair are more than 2 pips. This value is even higher than stated on the company’s website, which cannot be a positive marker.

Deposit and withdrawal of funds

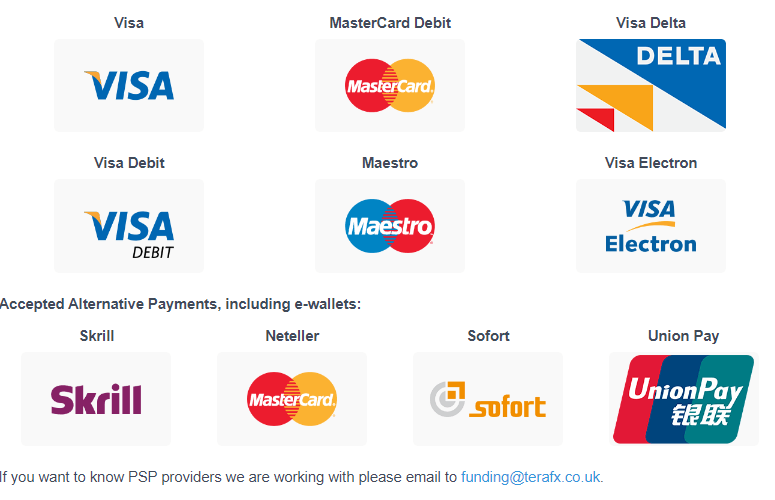

The methods of depositing and withdrawing funds at terafx.com are represented by:

- credit/debit cards;

- bank transfers and e-wallets (Skrill, Neteller, Sofort, UnionPay).

In addition to these methods, the broker offers other methods. You can find out about them by leaving a preliminary application. According to what customer reviews say about TeraFX, it is about crypto wallets.

The minimum amount for withdrawal is $100. The commission is not charged. If this is the trader’s entire balance, a one-time fee of $25 will be charged. The fee for inactivity within 6 calendar months is a maximum of $10. This amount will be deducted every six months, as long as you are not active on the broker’s platform.

Verdict

Despite the fact that TeraFX broker has a licence from one of the world’s most reputable regulators, many investors call it a fraudulent project and complain about the impossibility of withdrawing their earnings. In addition to that, we also learnt about excessive spreads, illegal leverage and a huge entry threshold for a micro-account at terafx.com. Of course, the decision about cooperation is yours alone. We can only advise you to carefully weigh all pros and cons. If you have the slightest doubts, it is better to turn to another dealing centre.