eToro has been in operation for eleven years (2007). Three years after its foundation, it introduced online social trading and investment software. The Republic of Cyprus is the place of its registration. eToro official website contains information that the operation of the brokerage firm and its representative offices is controlled by CySEC Cyprus, the EU MiFID Directive and the UK FCA.

eToro Trading Terms and Conditions

- Software – eToro platform, which allows to realise collective trading, uniting the user with millions of fellow traders; its mobile version for devices based on iPhone/iPad/Android operating system.

- Accounts – Standard. The initial cash deposit is 200 USD.

- Financial assets – currency ratios (47), exchange-traded funds (83), stocks (1296), indices (13), precious metals (4), energy (2) and cryptocurrencies (13).

- The maximum leverage is up to 1:400.

- The minimum spread is from three points.

- Methods of deposit/withdrawal – bank transfers, cards (Visa/MasterCard/Diner’s Club), EPS (PayPal, Skrill, Neteller, WebMoney, Yandex.Money, China Union Pay, GiroPay). For withdrawal of more than fifty dollars, the organisation in question charges a commission of twenty-five dollars.

Additional services

Beginners and professional traders are offered the possibility of training in the ‘Trading Academy’. Training areas are presented in the form of online courses, videos and webinars. For experienced speculators, there is an affiliate programme called ‘Introducing Brokers’, which allows you to receive a dividend for brought clients. Investors can also use the ‘CopyTrader’ service for automatic duplication of commercial transactions of successful traders. The smallest/highest amount of copying is equal to two hundred American dollars/not to exceed five hundred thousand. To diversify material threats, the user has the right to subscribe to alerts of up to one hundred successful speculators.

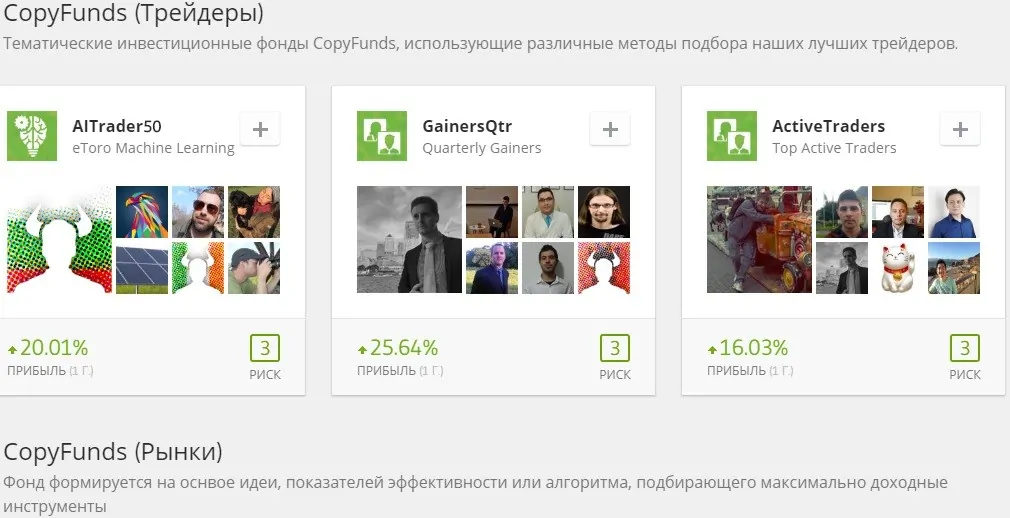

Also at the disposal of the dealing centre’s clientele is a proposal related to long and medium-term investment in the ‘CopyFunds’ fund. Within the framework of the latter there are three options for realisation of investments. The first one is ‘Top Trader’, investment funds of traders. The investor independently selects players to duplicate operations depending on the tactics they use. The second – ‘Market’, these structures are formed depending on the trading instruments involved (securities, currency pairs, indices, etc.). And finally, the third – ‘Crypto-currency’, here the role of the main asset is played by common crypto-coins.

There are a fair number of eToro reviews online, most of which are characterised by positive content. In such comments, players talk about the presence of reputable regulators, favourable investment opportunities, profitable social trading and good support. As for the negative opinions, participants complain about high spreads and increased starting depot.