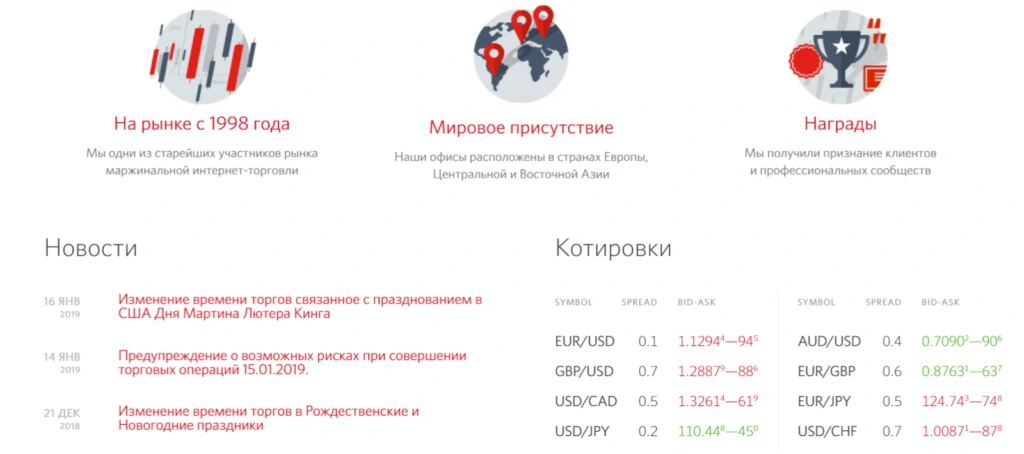

FIBO Group is an international broker. The first office of the holding was opened in 1998, after which other firms began to appear in different parts of the world. The corporation provides services to traders, giving them access to the international market and carrying out consulting activities. In this article, we will look at the features of the company and find out what trading conditions it offers to clients.

How does FIBO Group work?

The brokerage organisation holds a licence from the Financial Services Commission (FSC). Based on these documents, the firm can operate in several countries. If a trader has problems or conflicts with the company’s management, he can always turn to the regulator to resolve the issue in court.

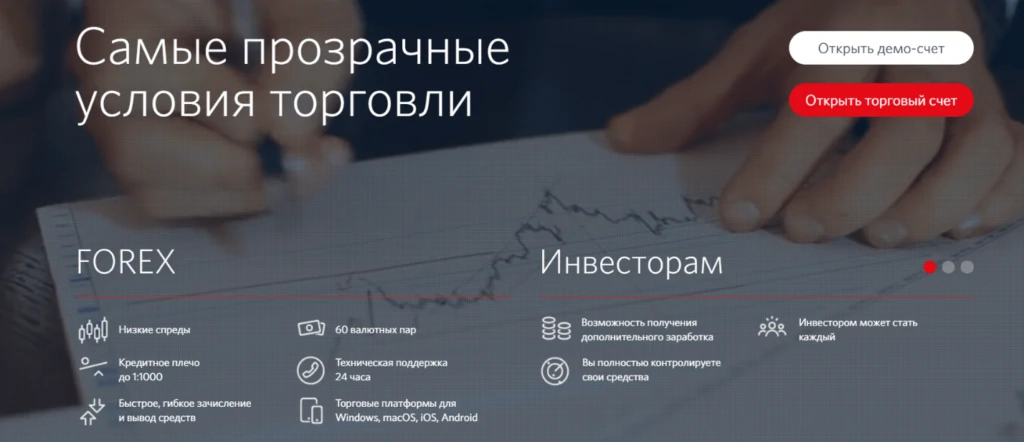

FIBO Group provides clients with the following trading conditions:

- Margin trading is available. Leverage reaches 1:1000.

- 60 currency pairs are available for trading.

- Technical support advises users 24 hours a day.

- The broker terminal is adapted to macOS, Windows, iOS and Android systems. There are several versions of the trading platform.

- Analytics is provided on the web resource of FIBO Group. The official site provides the client with news reports and analytical research.

- Training manuals and webinars are provided for beginners.

- Trust management is offered. If an investor does not want to work independently on the world stock exchange, he can entrust the disposal of funds to an experienced manager and receive regular profits. This option of earning involves its own risks, so before depositing money, it is necessary to choose the most professional trader.

- You can deposit or withdraw your earnings via SWIFT, Yandex.Kassa, Connectum, RegularPay, Bitcoin, Neteller, WebMoney and others. Each of these options involves its own commission charges and the term of crediting funds.

- There is an Islamic account. It is created specially for those who due to religious or other reasons cannot trade on general terms. There is no write-off for transferring positions, and all other parameters are the same as for regular accounts. Commission charges may increase due to the absence of swaps.

- There is an opportunity to gain additional profit through co-operation. A trader should invite friends, and in case of successful recommendation he will receive a part of the broker’s profit.

- Automatic trading is provided due to high-tech systems and allows to improve trader’s skills.

- PAMM-accounts are available. They can be used by beginners or traders who wish to rely on the experience of the manager.

- Among financial instruments there are Forex currencies, CFD contracts and spot metals. Each asset has its own liquidity and profitability, so the strategy should be initially thought out for the working instrument.

To understand the quality of the services described above, a trader should find out what clients think of FIBO Group. Reviews in the network allow you to identify the real advantages and disadvantages of the company, as well as to protect yourself from fraudsters and unprofessionals.

Types of accounts from FIBO Group

For those who have registered with FIBO Group, the personal cabinet provides an opportunity to choose one of the current tariffs:

- MT4 NDD provides direct trading with large-scale liquidity providers. The technology will be useful for those who trade intraday and prefer short-term transactions. The account can particularly benefit from the release of fundamental news in the economic calendar. There are no requotes on this tariff and spreads are minimal. Execution of orders is carried out with high speed.

- MT4 NDD No Commission assumes no commission charges. Otherwise, the tariff is similar to the previous option.

- MT4 Fixed is suitable for those who seek to use trading robots. The spread is of fixed type, it does not change with the release of significant news reports. The size starts from 2 pips. The tariff supports currencies and CFDs.

- MT5 NDD is recommended for scalping, intraday or automated trading. The trader can engage EAs, install trading robots and experiment with indicators. There is a ‘price stack’ on the platform, which simplifies volume analysis. There are no requotes on this tariff.

- cTrader NDD works similarly to MT4 NDD, only a different platform is provided for trading. Spreads are at a minimum level, it is possible to perform operations with CFDs, and there are no requotes.

- MT4 Cent is well suited for beginners, because the initial deposit starts from 0 cents. A trader deposits any amount and makes relatively safe transactions. In this mode, he can test the made strategy in real time and find out how effective it is. Leverage reaches 1:1000.

To be sure of the professionalism of your partner, read the information about Fibo Group. Reviews together with the official website can tell you a lot about the firm, but before funding your account, you should check the company’s presence in various lists. FIBO Group rating can be found on several thematic sites, as well as the presence in the black list.