The offshore company with the legal name AMarkets Limited is currently an international dealing centre with its registered office in St. Vincent and the Grenadines (a separate state in the Caribbean).

Despite the fact that the client contract is concluded with the company registered in SVG (St Vincent Grenada), the official headquarters is located in Montenegro.

Since its foundation, Amarketx has changed its brand twice. Thus, in 2007, a company called Adrenalin Forex appeared on the market of financial services, then, three years later, the firm changed the general concept of activity, calling itself AForex.

Since 2015 until today, the company has been assigned the final name – AMarkets, after which the management was satisfied with the trading system, creating almost limitless opportunities for earning money on stock exchanges and other profitable markets, and began to record a significant increase in the client base.

For eleven years, the intermediary company has been providing traders of all levels with access to the financial and stock markets to trade over 1,500 trading instruments, including CFDs and cryptocurrencies.

Amarkets operates under licence 22567 IBC 2015 from SVG FSA (Saint Vincent and the Grenadines Financial Services Supervisory Authority).

It should be noted that the financial activities of the online broker are supervised by FinCom (The Financial Commission), a self-regulatory organisation, where the company has been assigned the ‘A’ category. An independent resolution committee takes responsibility for resolving disputes between the dealer and its clients. As compensation, the broker can allocate up to $20,000 from the fund for an individual claim.

The broker assures the client of the safety of the capital in his account. Amarkets stability is due to the support of one of the four best auditing companies in the world Ernst & Young. In due time, the auditors checked the level of financial reliability of the company, having determined that the funds on the broker’s accounts significantly exceed the amount of total liabilities to its clients.

Within the framework of the fact that the funds are kept without the use of any schemes there is an absolute guarantee to satisfy the request of each client to withdraw fiat money from his account.

It is noteworthy that data from the official website of AMarkets indicates that this year the company has improved the trading technology, as a result of which the rate of order execution has increased significantly (up to three tenths of a second).

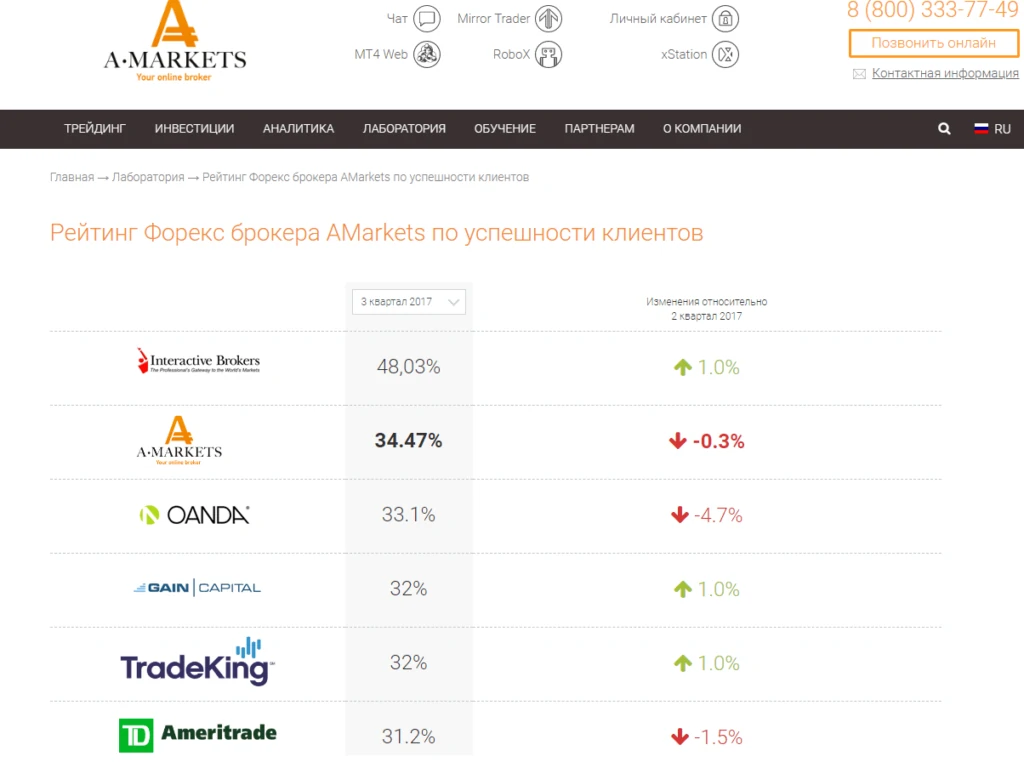

At AMarkets, the customer success rating as of July-September 2017 was quite high. The company ranked second in the top 6 brokers with the highest percentage of successful traders.

Varieties of all trading instruments available for trading and collected by AMarkets?

Today the broker offers clients a choice of the largest online trading tools, which allows the trader to cooperate with only one intermediary in the financial markets where it is possible to trade:

- on the rates of popular precious metals: gold, silver, aluminium, platinum, copper, zinc, nickel against the dollar or euro;

- major and cross-currency pairs (more than 50), including dollar/ruble and euro/ruble;

- 500 shares of influential global companies (CFDs);

- bonds

- bonds;

- 16 commodity exchange instruments (Brent/WTI oil, sugar, coffee, corn and others);

- 24 indices (S&P, Dow Jones and others);

- cryptocurrencies with the highest capitalisation on the market: Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC).

As a trading terminal, the broker offers for free popular software – Web-MetaTrader 4 (forex pairs, CFD futures), Android/iOS-based trading, as well as xStation, providing the necessary training materials for trading.

The company develops largely due to the system of affiliate programmes implemented at a fairly high level, so the broker is actively working in the direction of Internet attraction (traders-partners bring potential clients for further cooperation).

On the official website Amarkets offer clients to invest professionally through PAMM-service. The broker specifies that there are already ready-made investment portfolios and the innovative RoboX project.

However, experts believe that at the moment the company still has limited conditions for investors, because, according to experts, experienced traders are not given decent advertising conditions (PAMM accounts).

What kind of account is offered to open for a trader after verification on the Amarkets broker’s website?

To trade on one of the pre-selected platforms, the future market participant will be offered a choice of such account types:

- Classic (online trading on MT4 on PC or smartphone/tablet) with no minimum entry threshold;

- Direct (differs from the first one by a floating spread rather than a fixed one);

- ECN for trading gurus (min. deposit – $1,000) who want to get access to first-level interbank liquidity (NDD-technology). Order execution on this account is instant – fractions of a second;

- Institutional for large players (min. deposit – $100 thousand);

- Bitcoin for those who wish to trade three cryptocurrencies.

It should be noted that the company does not have cent accounts.

It should also be said that AMarkets will not provide its services to residents and ordinary citizens of the USA, England, Japan, North Korea, Iraq, Lithuania, Myanmar or Algeria.

On specialised rating sites AMarkets reviews are quite positive, although there are some good/bad ones duplicated on other similar sites. In case the client is dissatisfied with the provided service, the manager promptly contacts the author of the comment to resolve the problem.

Deposit/withdrawal of funds is carried out on favourable terms (commission-free deposit). To withdraw or replenish funds from the account, a trader can use a wide range of payment systems: plastic cards (Visa, Mastercard), fiat bank transfer (including in rubles), various electronic payment systems, and terminals.

Authoritative resources that make ratings of brokers have not added AMarkets to the black list.

AMarkets asks potential clients to carefully study the information on their official website. A future trader should make a decision on co-operation only after putting an objective assessment of their capabilities and risks. A trader should know the rules for managing funds (mani-management) and be able to control possible risks.