Forex spread is the difference between the optimal in the current period values of supply (Ask) and demand (Bid) for one ratio of currencies. It is a commission charged by a brokerage company to a trader for each start of a transaction (purchase or sale of a financial instrument). In trading spread affects the profitability of the tactics used, therefore it should be taken into account when making commercial transactions. The lower the commission, the more ideal the conditions of functioning for the speculator. On the international currency market the spread is expressed in the form of pips (pips). Such a measurement is considered to be quite comfortable, as it provides a chance to compare spreads on different assets.

But what does spread in Forex mean in simple words? It is a key earning item for the dealership. In a layout where the firm offers zero spread trading, the speculator will cover other types of commission write-offs that are set by the dealing centre.

Forex spread: typology

- Low Forex spread (narrow)/wide spread – up to/over 5 pips. Spread value depends on the liquidity level of a particular instrument: the greater the possibility of an asset to be easily realisable, the lower the spread volume, and vice versa.

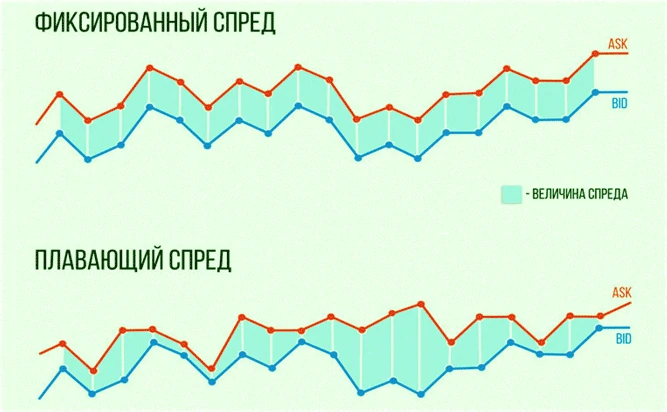

- Fixed – has one and the same indicator, regardless of the existing state on the platform. Three main advantages of the fixed commission can be distinguished. The first is protection from situations when the spread suddenly and lightning increases. The second is ‘ironclad’ confidence that the order for Buy/Sell will be carried out according to the Ask/Bid quotes set at the moment. The third is a chance to correctly pre-calculate the profitability of the trading system.

- Floating – its size directly depends on the current market situation, the most important events from the world of economy, the proportion of supply/demand, as well as trader activity. This is the most common type of spread on Forex. When volatility increases, such a commission can grow and reach, for example, eight to ten points. If the volatility of the mood of authoritative traders decreases, the floating spread falls, sometimes to 0.1 points. The main disadvantage of this spread variety is that traders need to systematically make corrections according to the situation that prevails in the market.

Choosing the best option

For traders, whose labour is aimed at a long term perspective, it does not matter at all what kind of spread to work with. As its value in any circumstances will take up a smaller part of the income or loss in each trade. However, experts still recommend choosing floating values in this situation. For players oriented to trading with average time intervals, fixed indicators will be more profitable. Thanks to this, they will be able to avoid a sudden spread increase in the hours of increased activity on the site. For short-term tactics, scalping and pips it is necessary to create accounts with a floating type of spread, as its share will be significant in the result of the operation.

A number of factors have an impact on spread determination. These include a predilection for a dangerous trading methodology, the style of activity, and the ability of participants to make immediate decisions when the market is more dynamic. Those traders who like to work within the framework of significant changes in exchange rates most likely prefer floating spread. Analysts often argue that fixed commissions are considered unattractive for speculators who are used to using risky methods, while floating commissions reduce the total loss of trading positions.

Professionals advise those who have just started to function on Forex as a trader to use fixed spreads because of the relative ease of working with them. With the passage of time and accumulation of experience, you can switch to a floating option. It should be remembered that the indicator in question is a variable value, depending on the current circumstances, brokerage conditions, etc. By determining the favourable trading criteria (with the volume and type of commission), the trader determines the success of his own functioning. Not always minimum Forex spreads are characterised by optimal trading parameters, as brokers can charge speculators additional money.